Manually Add Tenant Events

ProLink Solutions provides the option to add tenant events manually.

Property owner/managers can enter tenant events at whatever frequency the agency business process dictates, whether annually, quarterly, or even monthly. For example, if the agency's deadline is March 30, then property owners/managers can add events for the 2018 compliance review period throughout 2018 and until March 30, 2019.

Tip

You can navigate within a WorkCenter using the breadcrumbs located at the top of the screen.

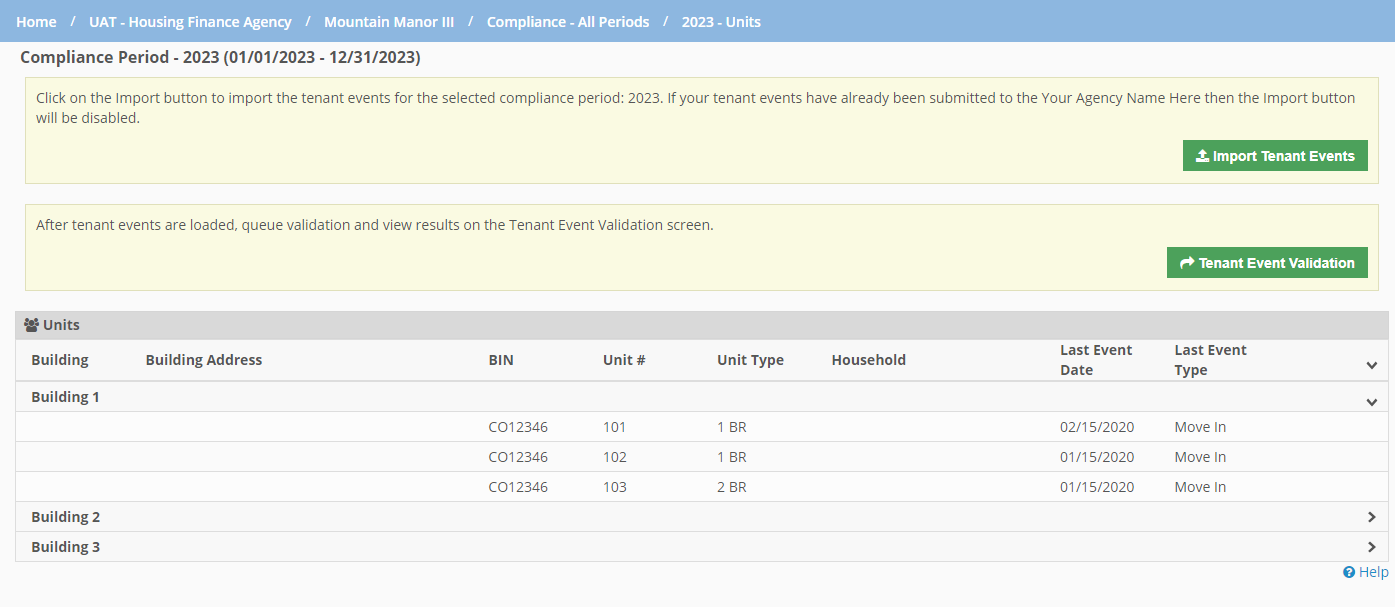

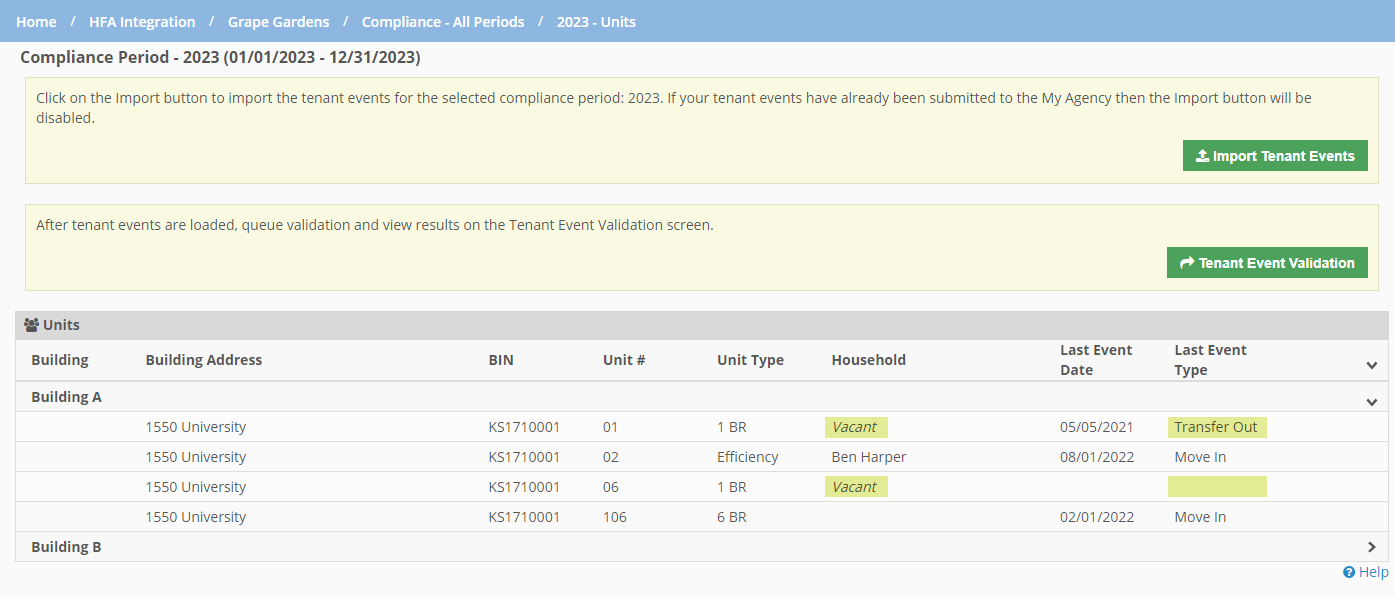

Click View Tenant Events for the compliance period to view its units and tenant events.

The List Units screen opens.

Depending on the app configuration, the List Units screen might show the units grouped by building. Click the arrows at the right of the grid to expand or collapse the building information.

The Household column shows "Vacant" if the last event was a Move Out or Transfer Out event type or there are no tenant events for the unit.

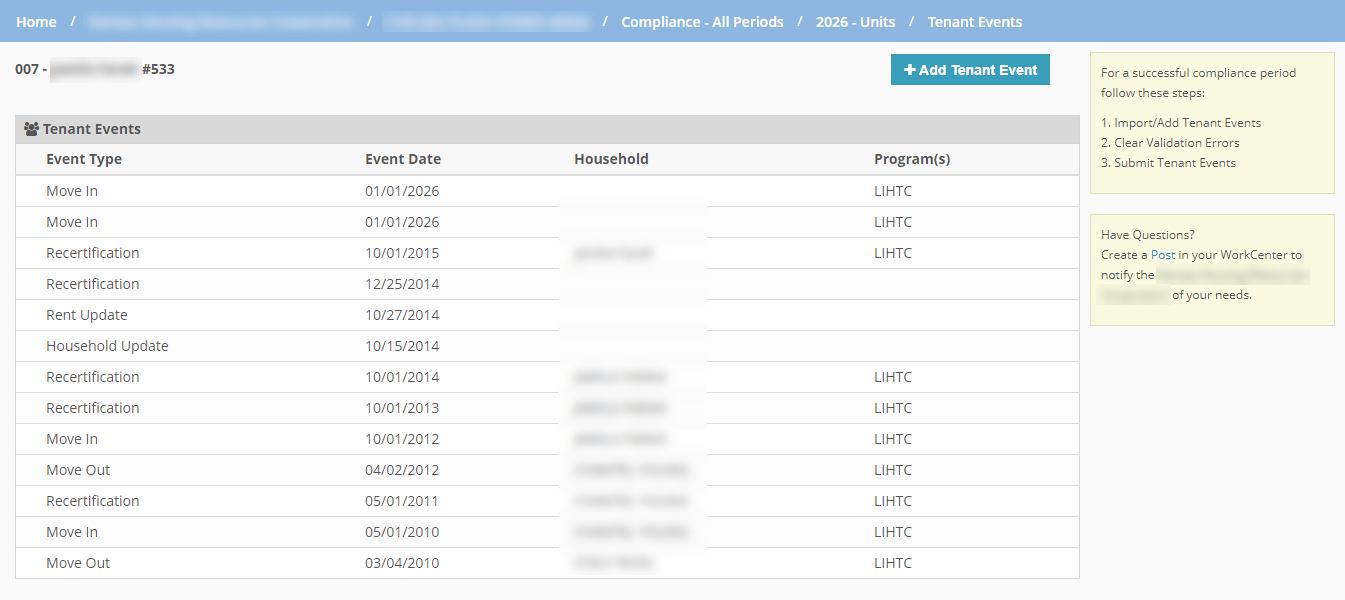

Click the row of the unit to view the tenant events for the unit.

The List Tenant Events screen opens.

Click Add Tenant Event.

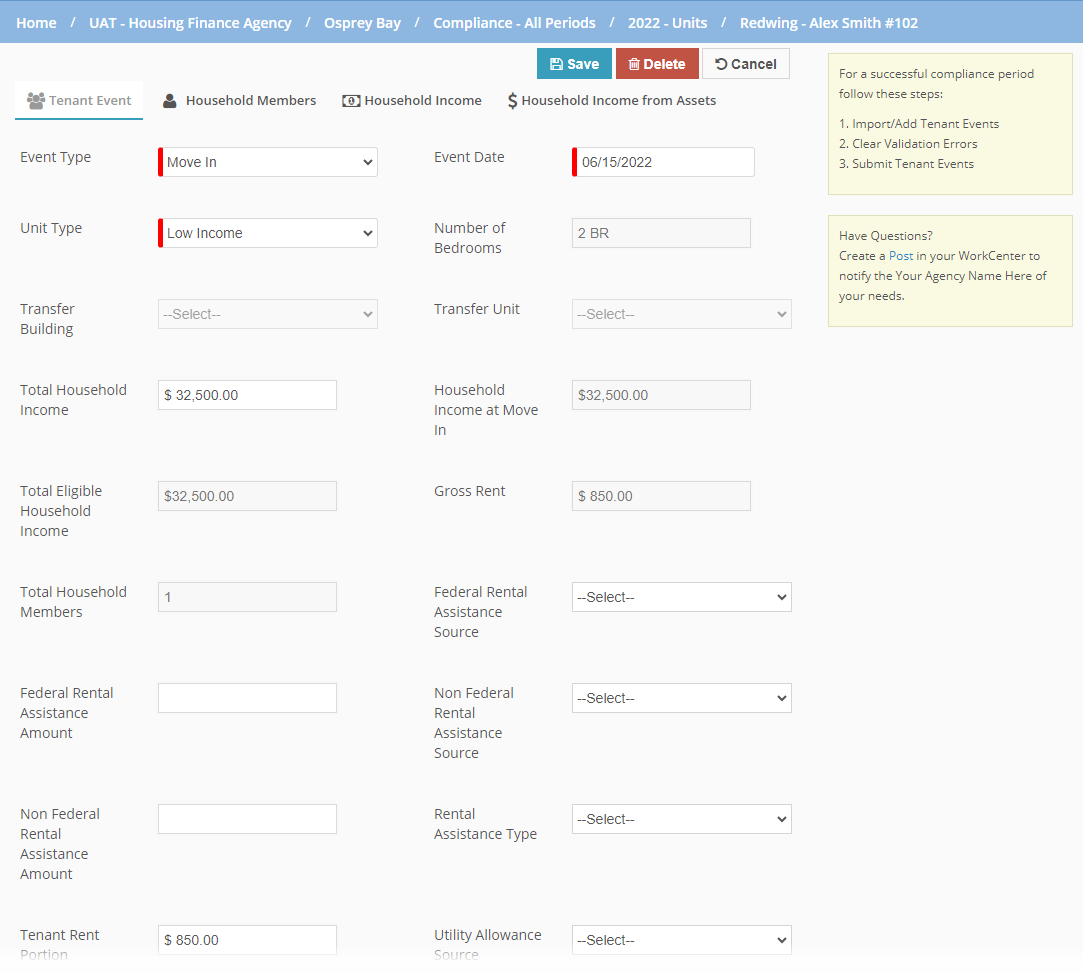

Enter the Event Type, Event Date, Unit Type, and any other general information at the top of the form as needed.

Click Save.

You can now enter additional information about the tenant event.

Depending on the agency's system configuration, the Total Household Income field might be read-only or editable.

If the field is editable, you can enter a value for the Total Household Income in place of creating household member income record(s).

Keep in mind that the system calculates income and assets for Total Household Income, which overrides any manually entered amount. If you import tenant events, and the XML contains an income or asset record, then system calculation will be used. If no income or asset records exist, then the system uses the annual income value from the XML.

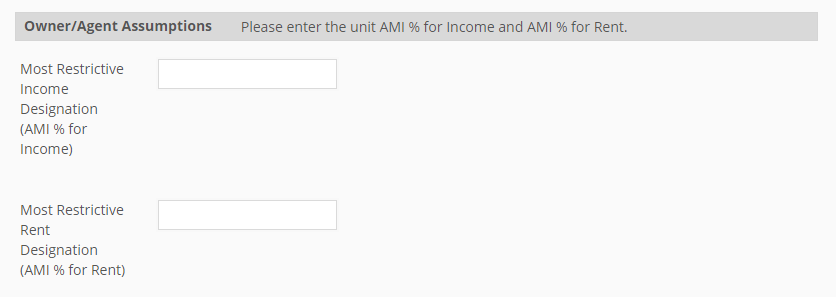

Optionally, enter the owner/agent assumptions about the Most Restrictive Income Designation (AMI% for Income) and Most Restrictive Rent Designation (AMI% for Rent).

The agency system administrator must have enabled the Owner/Agent Assumptions section for it to be displayed. See Configure the Tenant Portal for more information.

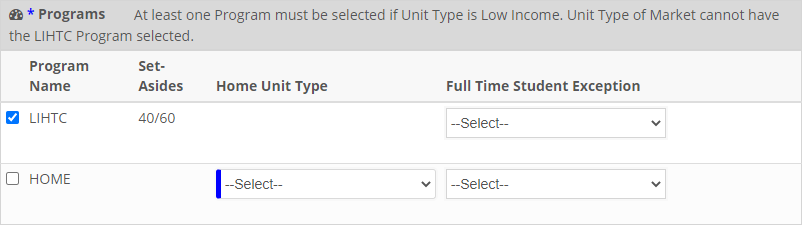

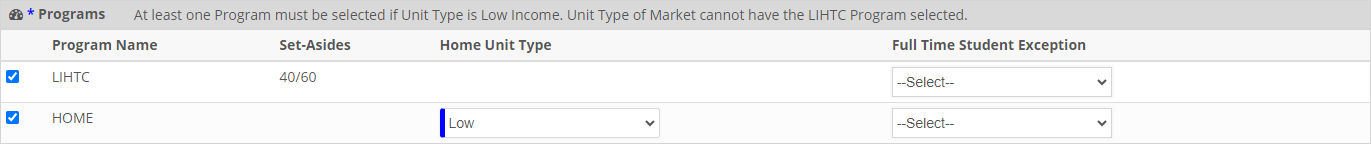

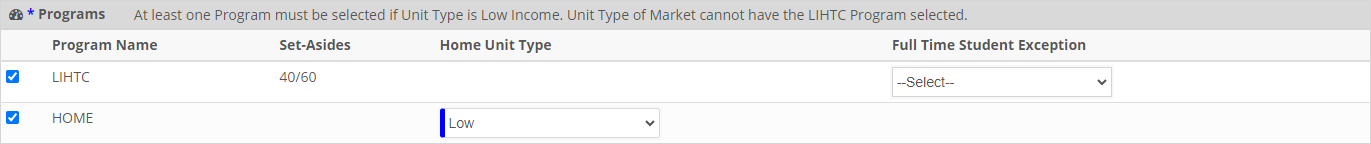

If you selected Low Income in the Unit Type list, complete the Programs grid.

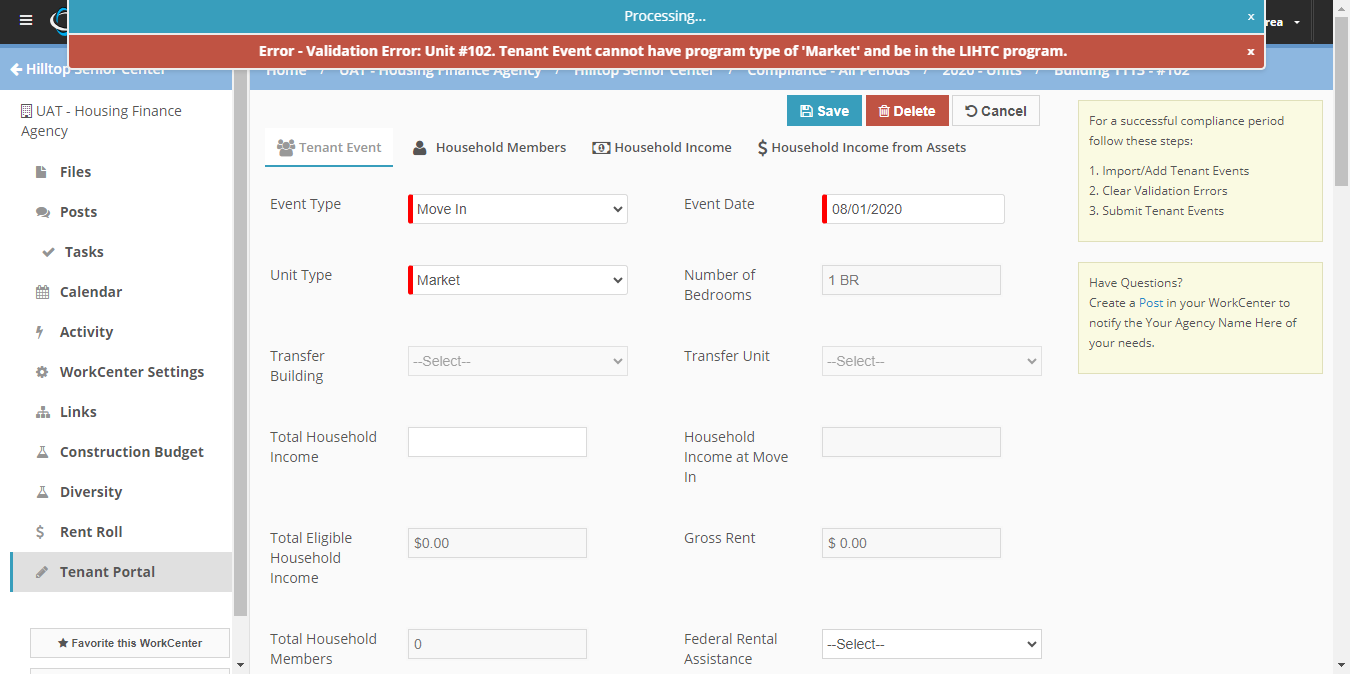

Caution

Only select the LIHTC program when the unit type is Low Income. Market units should not include the LIHTC program.

The Tenant Portal will present an error when a market unit is added or uploaded with the LIHTC program selected.

If the compliance review period start date is greater than or equal to the HOMEStudentRuleComplianceSwitchStartDate configuration date, then the HOME Full Time Student Exception list is not visible.

Programs section in the Tenant Portal for an event before the config setting date; Programs section in the Tenant Portal for an event after the config setting date

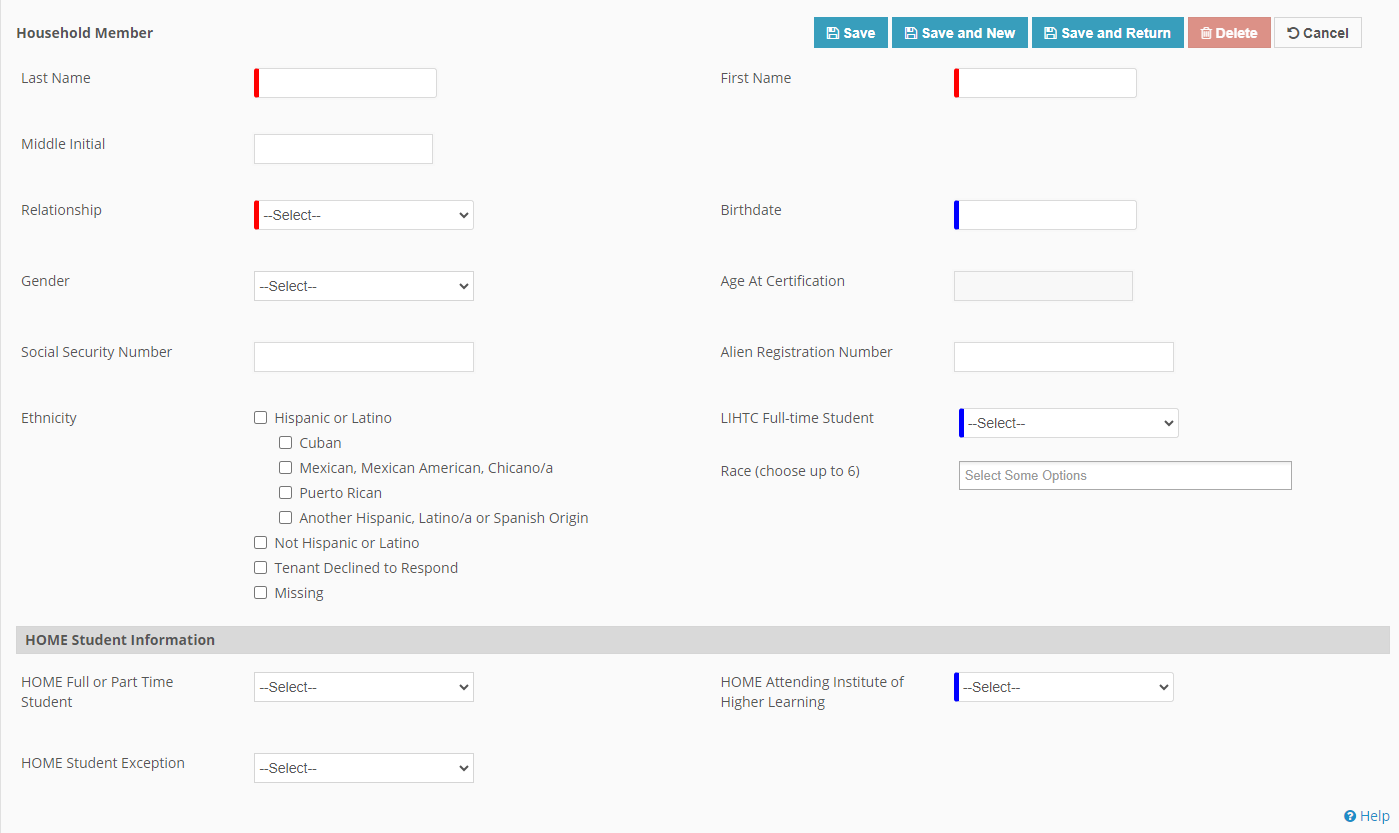

Click the Household Members tab, and then click Add Household Member to open a screen where you can enter and save information about a household member.

Tip

Use the Tenant Event breadcrumb link or click Cancel to return to the Tenant Event screen.

Note

When the HOME program is selected on the Tenant Event tab (Programs section), then the HOME Student Information section on the Household Member screen is displayed and the HOME Attending Institute of Higher Learning field is required for compliance. If the HOME program is not selected, the fields are hidden.

When the LIHTC program is selected on the Tenant Event tab (Programs section), then the LIHTC Full Time Student field is required for compliance.

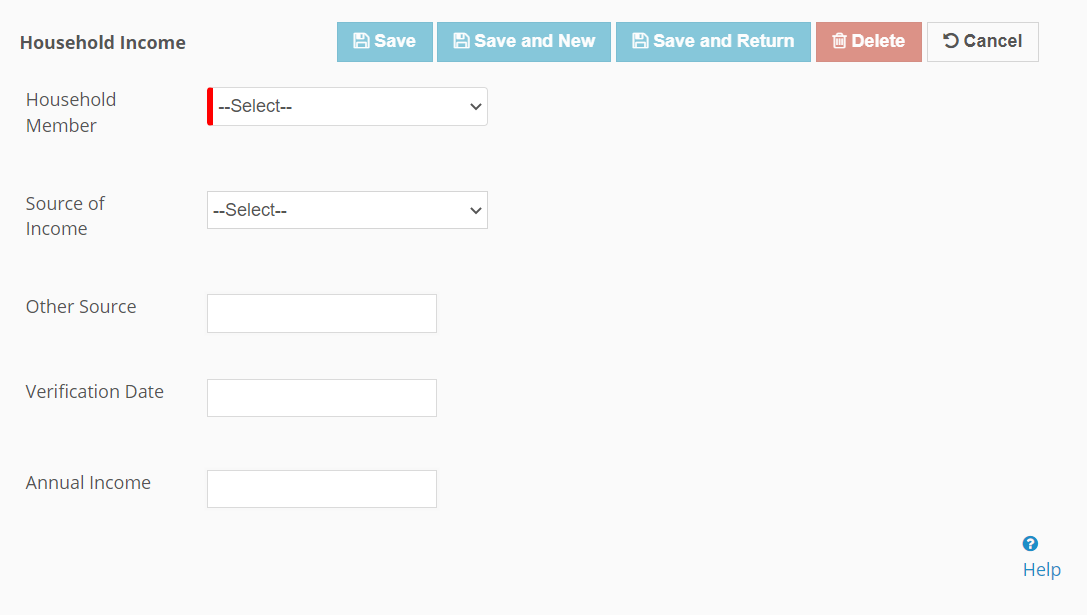

Click the Household Income tab, and then click Add Household Income to open a screen where you can enter and save information about household income.

If the event date is on or after the agency's HOTMA Effective Date, select the Source of Income.

Note

The HOTMA Effective Date is a ProLink-only system configuration that defines the agency's enforcement date for the Housing Opportunity Through Modernization Act (HOTMA) rules. The default is July 1, 2025.

Note

The latest date for HOTMA LIHTC compliance is 7/1/2025. The latest date for HOTMA HOME compliance is 1/1/2026. Agencies should use the earliest acceptable date for the program(s) monitored for the HOTMA Effective Date.

The read-only Earned Income Type field shows "Earned" or "Unearned" based on the household member's Source of Income. With the Housing Opportunity Through Modernization Act (HOTMA), HUD requires the inclusion of unearned income up to the Dependent Deduction Amount for full-time student dependents.

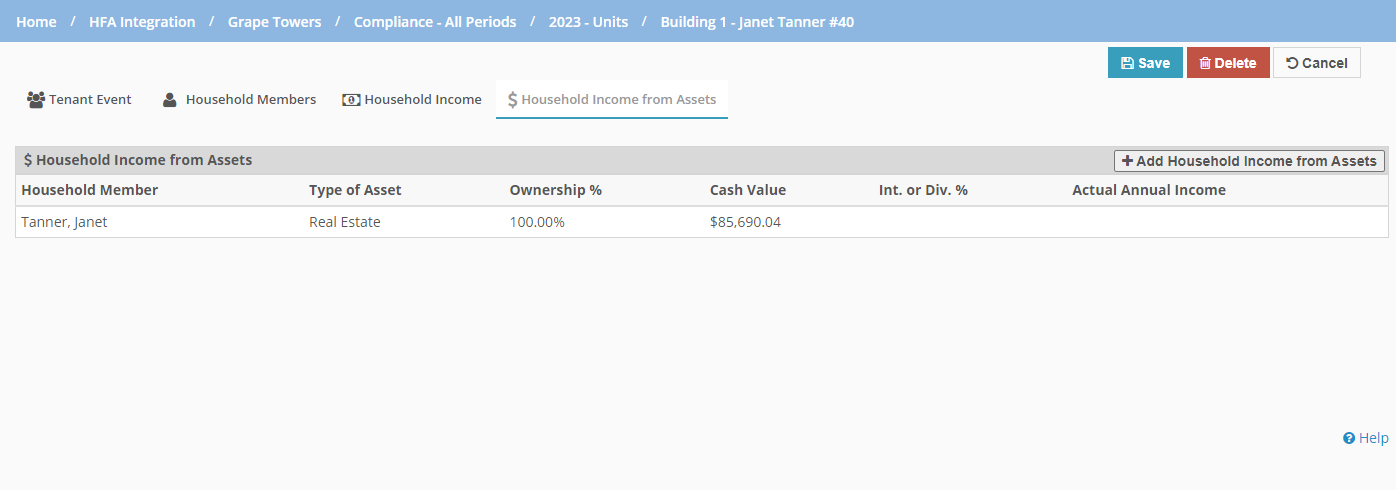

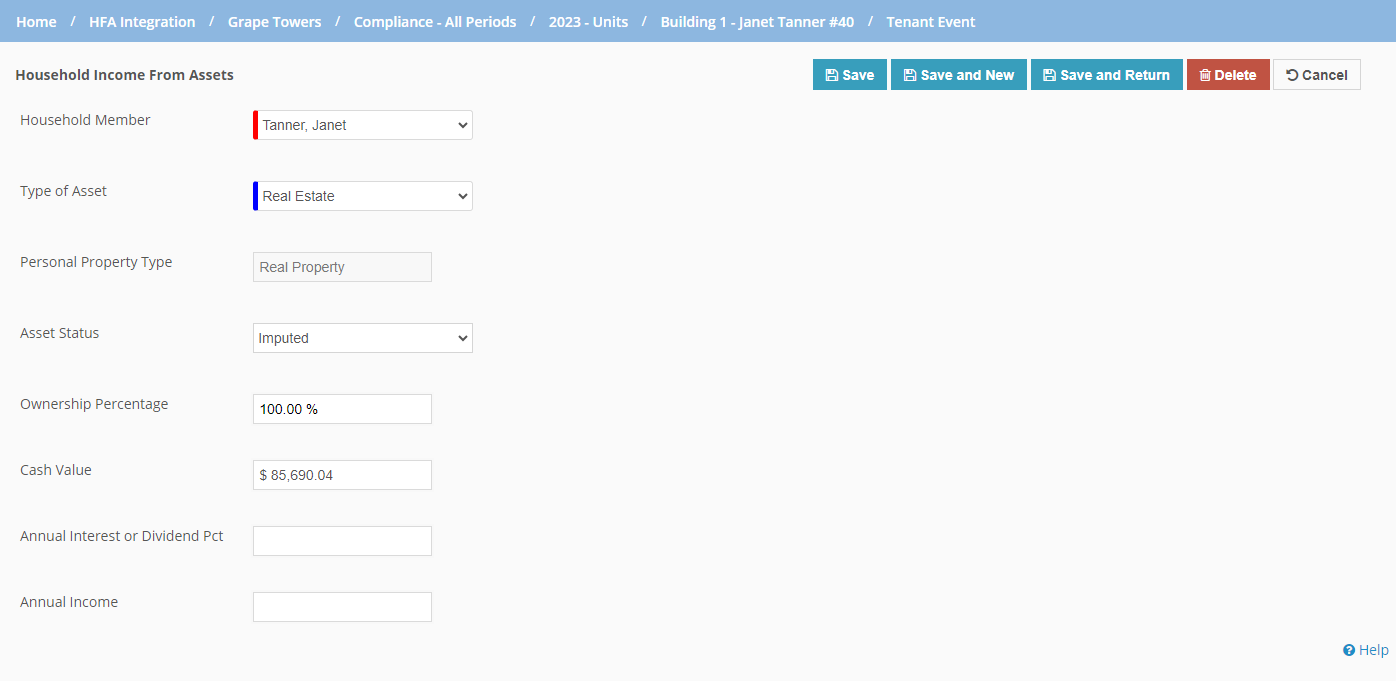

Click the Household Income from Assets tab, and then click Add Household Income from Assets to open a screen where you can enter and save information about household income from assets.

If the event date is on or after the HOTMA Effective Date, select the Type of Asset, Personal Property Type (Asset Code), and Asset Income Type.

See also HOTMA and Household Income from Assets.

Household Income from Assets summary and detail screens for tenant events dated on or after the HOTMA Effective Date

Household Income from Assets summary and detail screens for tenant events dated before the HOTMA Effective Date

Click Save.

Note

To edit an existing tenant event, click the row of the tenant event in the List Tenant Events screen. Make the necessary changes, and click Save.

To delete a tenant event, click the row of the tenant event in the List Tenant Events screen. Click Delete at the top of the page, and then confirm the deletion.

If you need to edit or delete tenant event data for a compliance review period that is already Submitted or Submitted and Finalized, you need to contact the agency.

Important

Remember to validate and submit the tenant events to the agency!

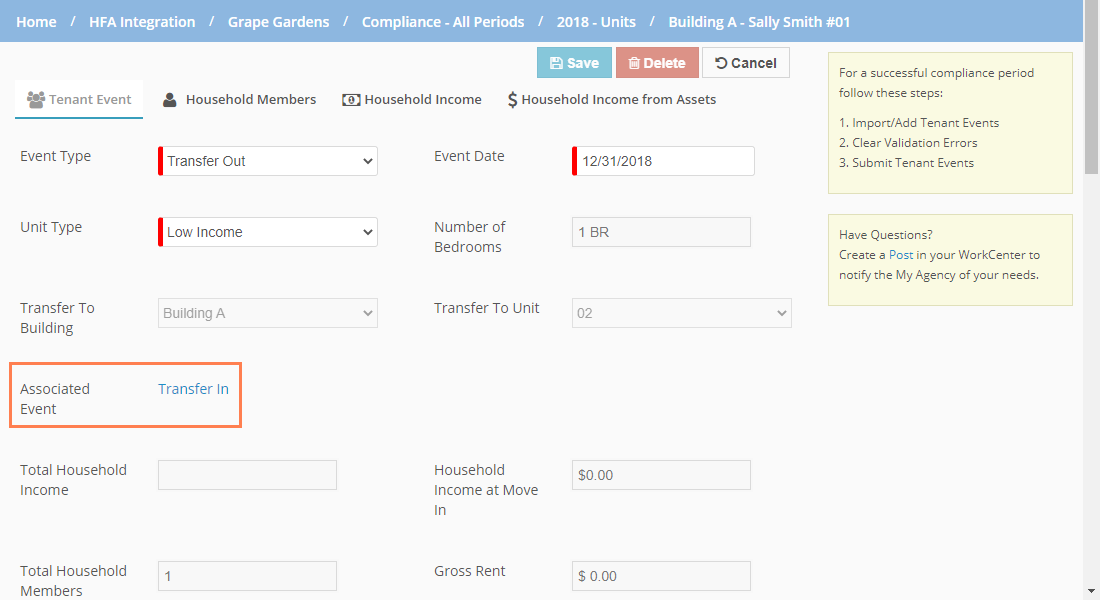

Transfer In and Transfer Out events are linked in the system so that you can better manage these events.

When a Transfer In event is created, the system automatically creates a Transfer Out event, with the household members, household income, and household income from assets copied to the associated event. Similarly, when a Transfer Out event is created, the system automatically creates a Transfer In event.

If an event occurs after a Transfer Out (other than Transfer In), the system does not copy household members, household income, or household income from assets to the new event.

Creating a Transfer event also copies the household members, household income, and household income from assets from the prior event for the unit, if applicable.

You can navigate between the linked Transfer events using the Associated Event link.

If the building or unit is incorrect for a Transfer event, you will need to delete the events and start over.

When you delete a Transfer event or you change the event type, then the system automatically deletes the associated event.

The system allows a one-day gap between the associated Transfer In and Transfer Out events to support HUD's grace period. For gaps greater than one day, the system presents an error.

The compliance engine will test Initial Certification events the same as Recertification events.

The system updates the Initial Move In Date/Initial Certification Date field when Initial Certification is selected, using that event date as the new Initial Move In Date/Initial Certification Date for any event types after the Initial Certification event.

An Initial Certification event cannot follow a Move Out or Transfer Out event, and Initial Certification cannot be the first event on a new unit. Initial Certification must follow a Move In, Transfer In, or Recertification event.

The following adjustment event types can occur in between the Move In, Transfer In, or Recertification event and the Initial Certification event: Household Update, Rent Update, Student Update.

You cannot select Initial Certification as the Event Type when the Unit Type = Market or Employee.

Important

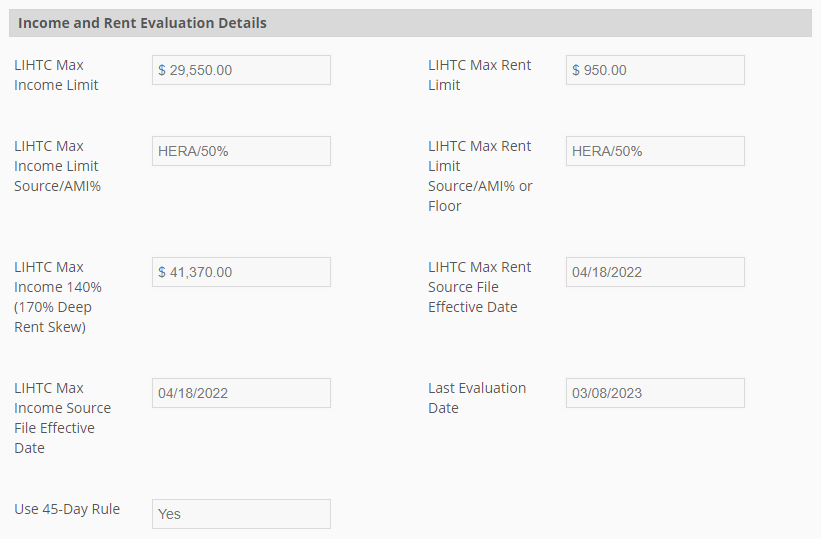

The Account Administrator must turn on a configuration setting to show the Income and Rent Evaluation Details section. See Configure the Tenant Portal for information about configuring the Tenant Portal.

You can view the system-calculated evaluation data for a tenant event:

LIHTC Max Income Limit—Displays the LIHTC Max Income Limit based on what the compliance engine will use to test income for the event.

When the Federal Minimum Set Aside on the Building (BIN) is set to Average Income, then the LIHTC Max Income Limit field will use the AIT Unit Designation % to determine the max income limit to display, using the most recent AIT Unit Designation effective date equal to or prior to the Tenant Event Date.

LIHTC Max Income Limit Source/AMI %—Displays the source of the max income limit and the project set aside for the value in the LIHTC Max Income Limit field.

When the Federal Minimum Set Aside on the Building (BIN) is set to Average Income, then the LIHTC Max Income Source/AMI% field will use the AIT Unit Designation % as the AMI%, using the most recent AIT Unit Designation effective date equal to or prior to the Tenant Event Date (that is, the AIT Unit Designation % that was used to test income and rent).

LIHTC Max Income 140% (170% Deep Rent Skew)—Displays the calculated value based on the income limit for the project set aside % for the number of people x 140%.

When the Federal Minimum Set Aside on the Building (BIN) is set to Average Income, then the LIHTC Max Income 140% (170% Deep Rent Skew) field will be updated for AIT as follows:

When AIT Unit Designation = 20, 30, 40, 50 or 60, then the 140% calculation will use the Designated Income Limit for 60% x 140%.

When AIT Unit Designation = 70, then the 140% calculation will use the Designated Income limit for 70% x 140%.

When AIT Unit Designation = 80, then the 140% calculation will use the Designated Income limit for 80% x 140%.

LIHTC Max Income Source File Effective Date—Displays the effective date of the source file.

Last Evaluation Date—Displays the date the last evaluation occurred to test income and rent.

LIHTC Max Rent Limit—Displays the LIHTC Max Rent Limit based on what the compliance engine will use to test income for the event.

When the Federal Minimum Set Aside on the Building (BIN) is set to Average Income, then the LIHTC Max Rent Limit field will use the AIT Unit Designation % to determine the max rent limit to display, using the most recent AIT Unit Designation effective date equal to or prior to the Tenant Event Date.

LIHTC Max Rent Limit Source/AMI% or Floor—Displays the source of max rent limit and the project set aside for the value in the LIHTC or the Gross Rent Floor in the Max Rent Limit field.

When the Federal Minimum Set Aside on the Building (BIN) is set to Average Income, then the LIHTC Max Rent Source/AMI% or Floor field will use the AIT Unit Designation % as the AMI%, using the most recent AIT Unit Designation effective date equal to or prior to the Tenant Event Date (that is, the AIT Unit Designation % that was used to test income and rent).

LIHTC Max Rent Source File Effective Date—Displays the effective date of the source file or Gross Rent Floor effective date.

Use 45-Day Rule—Displays "Yes" when Use 45 Day Rule is selected for the BIN on the LIHTC Income Limits tab for the Compliance Review Period, or displays "No" when the checkbox is not selected.

Data is populated after a compliance review evaluation is executed.

The compliance engine does not test income and/or rent for certain event types. If an event type is not tested for income and/or rent, then the corresponding evaluation data fields will not be populated. Some examples:

Rent Update does not test income

Student Update does not test income or rent

Household Update does not test rent

Transfer In does not test rent

If a unit has the AIT Unit Designation of Excluded or Market, then Income and Rent is not tested and the fields will be blank.

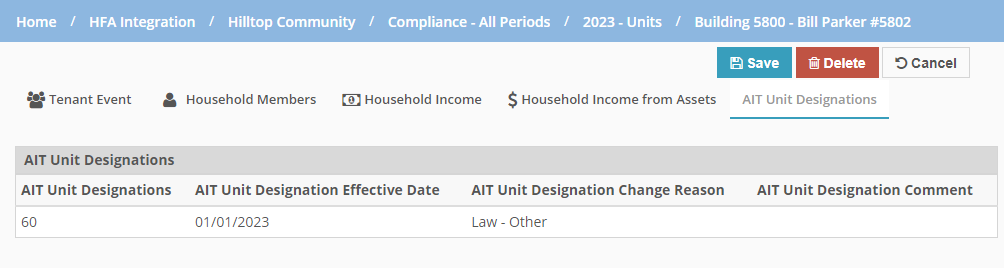

The Tenant Event record in the Tenant Portal includes a tab that shows the read-only AIT Unit Designation history for the unit. The tab is only visible when the unit is part of an average income BIN/building.

Tenant Portal includes validation to ensure the unit type on a tenant event correlates to the AIT unit designation where the most recent AIT unit designation effective date is prior to or equal to the tenant event date.

The app checks that when the Unit Type = Low Income, the current AIT Unit Designation is a value between 20–80 or Excluded. The app also checks that when the Unit Type = Market or Employee, the current AIT Unit Designation = Market or Excluded. If either of these conditions are not met, then the app presents a validation error on the tenant event.

For more information about average income unit designations, see Average Income Designations in the Tenant Portal.

HOTMA, or the Housing Opportunities Through Modernization Act, revises HUD regulations related to HOME and LIHTC programs. To accommodate HOTMA regulations, for tenant events as of the agency's HOTMA Effective Date and later, the system takes into consideration the imputed annual income of the household as well as the type of asset.

Note

The HOTMA Effective Date is a ProLink-only system configuration that defines the agency's enforcement date for the Housing Opportunity Through Modernization Act (HOTMA) rules. The default is July 1, 2025.

Note

The latest date for HOTMA LIHTC compliance is 7/1/2025. The latest date for HOTMA HOME compliance is 1/1/2026. Agencies should use the earliest acceptable date for the program(s) monitored for the HOTMA Effective Date.

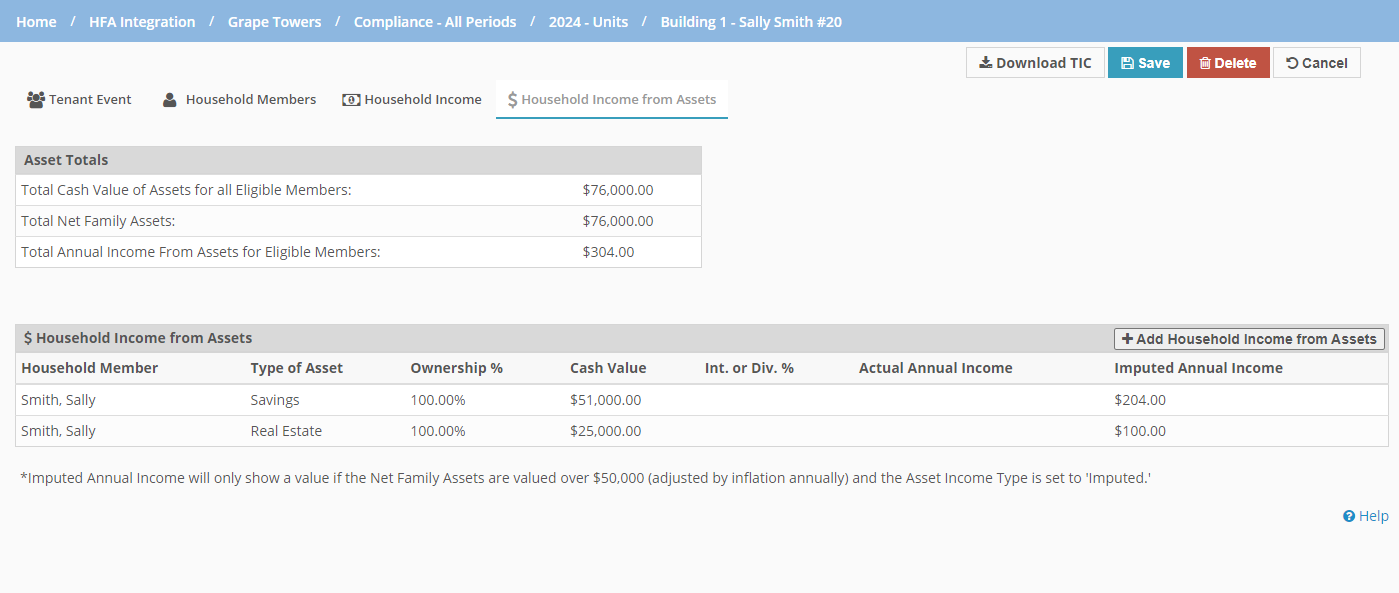

For events dated on the agency's HOTMA Effective Date and later, the summary screen includes the following Asset Totals:

Total Cash Value of all Assets for Eligible Members—Sum of Cash Value amounts multiplied by corresponding Ownership Percentage in each row of the Household Income from Assets grid for all eligible members, excluding Asset Type = IRA/Keough and Retirement Plan.

Total Net Family Assets for Eligible Members—Calculation is as follows:

Sum all assets/property marked as Real Property or Other Real Property. Sum all assets/property marked as Federal Tax Refund or Credit. Sum all property marked as Non-Necessary Property (excluding IRA/Keough and Retirement Plan).

If the sum of all Non-Necessary Personal Property is under or equal to the current Imputed Asset Limit, the system adds "0" to the sum of all Real Property and subtracts the Tax Credit sum. If the sum of all Non-Necessary Personal Property is over the current Imputed Asset Limit, the system adds the sum of all Non-Necessary Personal Property to the sum of all Real Property and subtracts the Tax Credit sum. This is the Total Net Family Asset value. If the subtraction of the Tax Credit value results in a negative number, the system uses "0".

Note

If the Total Net Family Asset value is less than or equal to the current Imputed Asset Limit, the system does not impute any assets. If the Total Net Family Asset value is greater than the current Imputed Asset Limit, the system imputes any assets with the Asset Status of "Imputed."

Note

For an asset record where Personal Property Asset Code = T - Federal Tax Refund or Credit, the value is treated is a negative value in the Total Net Family Assets for Eligible Members calculation.

Total Annual Income From Assets for Eligible Members—Sum of Total Actual Annual Income from Assets for Eligible Members and Total Imputed Annual Income from Assets for Eligible Members, excluding Asset Type = IRA/Keough and Retirement Plan.

The system displays this value in the Total Eligible Annual Income field on the Household Income tab and in the Total Eligible Household Income field on the Tenant Event Main tab.

Note

Eligible members excludes Live-In Aide, Foster Child/Adult and Pending Foster (for events on or after the agency's HOTMA Effective Date), and None of the Above household members.

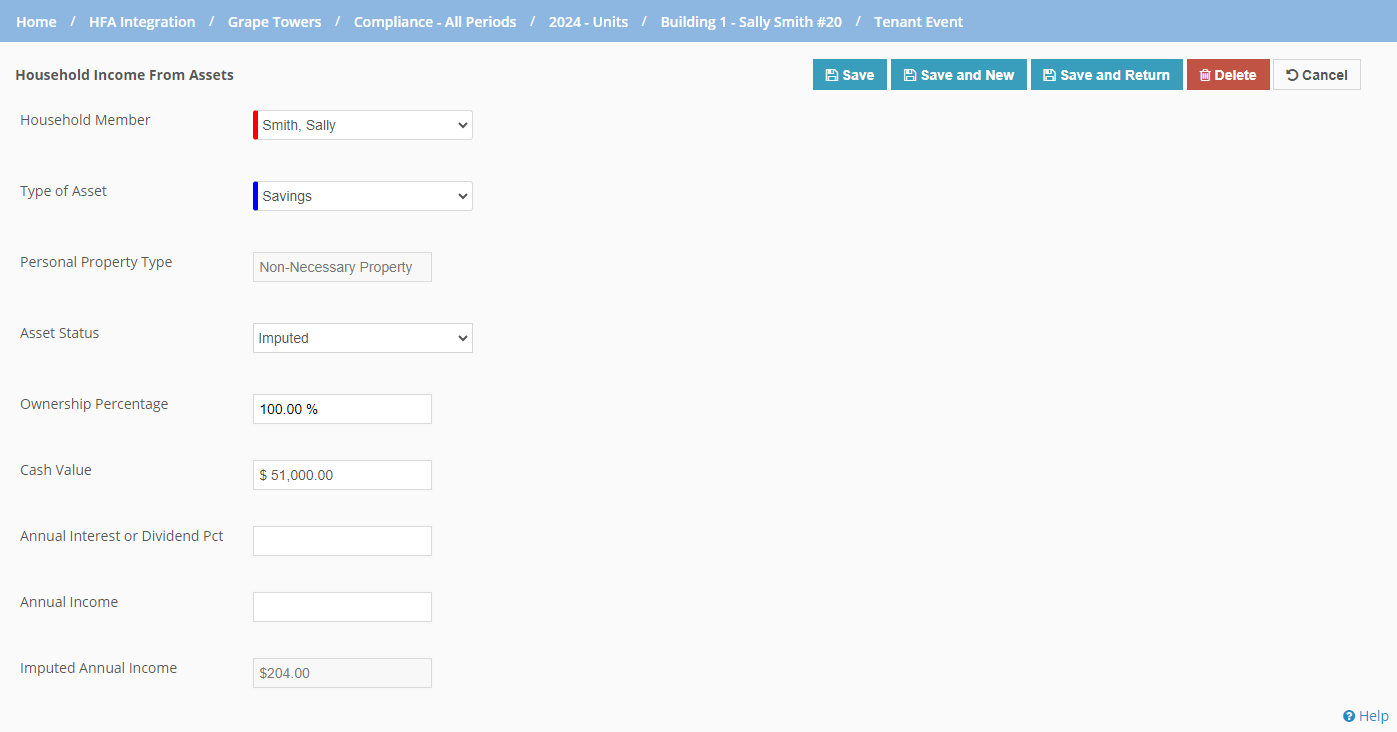

For events dated on the agency's HOTMA Effective Date and later, the edit screen includes the Imputed Annual Income if the cash value of the net family assets are valued over $50,000 (or adjusted by inflation annually) and the Asset Income Type is set to "Imputed."

For tenant events on or after the agency's HOTMA Effective Date, the Type of Asset is required because it is used to calculate net family assets, which helps determine whether assets are imputed. The Asset Income Type field is also required for these events.

The Personal Property Asset Type field indicates whether the selected asset is Real Property (Real Estate) or Non-Necessary (all assets other than Real Estate).

Note

To ensure the Tenant Income Certification (TIC) form can be printed, ProLink must enable the ProLink-only Default HOTMA Asset Fields configuration setting. Additionally, the HOTMA Effective Date must be set to January 1, 2024 for the TIC form to function correctly. The TIC form was created based on HOTMA rules.

When the configuration setting is enabled, the system automatically defaults the following fields for new asset records or records imported through XML version 7 or lower:

Type of Asset—"Other"

Personal Property Type (Asset Code)—"Non Necessary Personal Property"

Asset Type—"Actual"

As a result, owner/agents will be able to import and save assets without encountering errors related to these required fields.

Owner/agents should review and update the default values if they do not accurately represent the asset. The owner/agent and agency will be responsible for ensuring assets are entered correctly when this default configuration setting is enabled.