Download the Tenant Income Certification Form

Tenant Portal users can download and print a simple Tenant Income Certification, or TIC, form from the Tenant Event screen. The form is specific to the LIHTC program or Additional Set-Aside program. The form is applicable to all events on or after the agency's HOTMA Effective Date. You cannot download the form for Employee unit types.

Note

The HOTMA Effective Date is a ProLink-only system configuration that defines the agency's enforcement date for the Housing Opportunity Through Modernization Act (HOTMA) rules. The default is July 1, 2025.

Note

The latest date for HOTMA LIHTC compliance is 7/1/2025. The latest date for HOTMA HOME compliance is 1/1/2026. Agencies should use the earliest acceptable date for the program(s) monitored for the HOTMA Effective Date.

Note

To ensure the Tenant Income Certification (TIC) form can be printed, ProLink must enable the ProLink-only Default HOTMA Asset Fields configuration setting. Additionally, the HOTMA Effective Date must be set to January 1, 2024 for the TIC form to function correctly. The TIC form was created based on HOTMA rules.

When the configuration setting is enabled, the system automatically defaults the following fields for new asset records or records imported through XML version 7 or lower:

Type of Asset—"Other"

Personal Property Type (Asset Code)—"Non Necessary Personal Property"

Asset Type—"Actual"

As a result, owner/agents will be able to import and save assets without encountering errors related to these required fields.

Owner/agents should review and update the default values if they do not accurately represent the asset. The owner/agent and agency will be responsible for ensuring assets are entered correctly when this default configuration setting is enabled.

Before owner/agents can access the TIC form for tenant events, the agency administrator needs to enable the functionality in the Tenant Portal. See Configure the Tenant Portal for more information.

Navigate to the Tenant Portal for the property WorkCenter.

The Compliance Periods page opens.

Click View Events for the applicable period.

The Compliance Period {Year} page opens.

Click the row of the applicable unit.

The tenant event list page for the unit opens.

Click the row of the applicable tenant event.

The Tenant Event edit page opens.

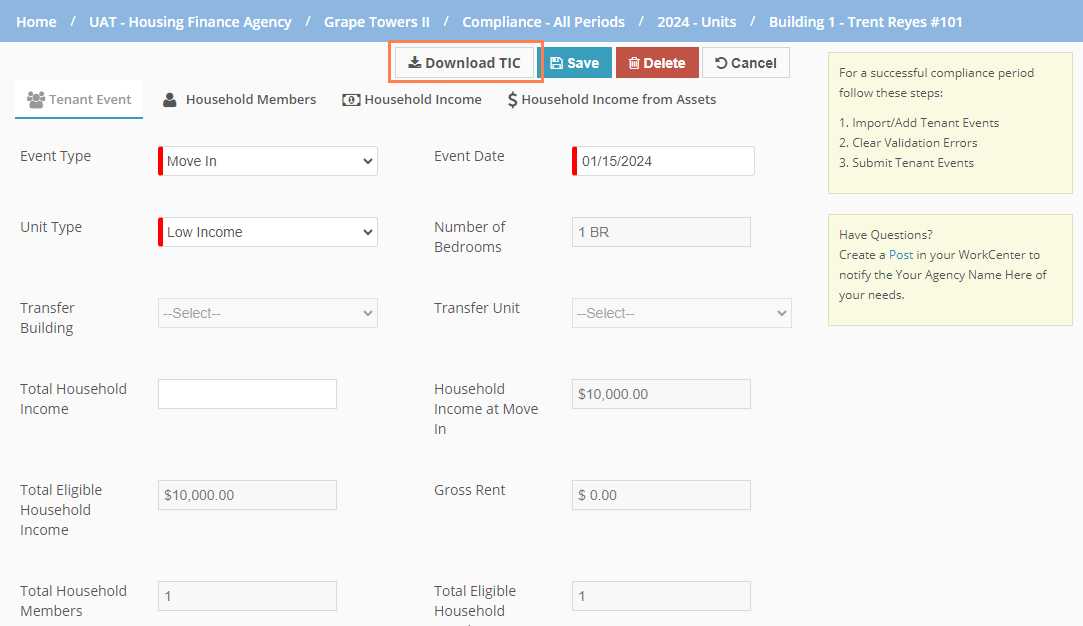

Click Download TIC at the top of the page.

Save or print the form as needed, provide to the household for signature, and complete the owner/representative signature.

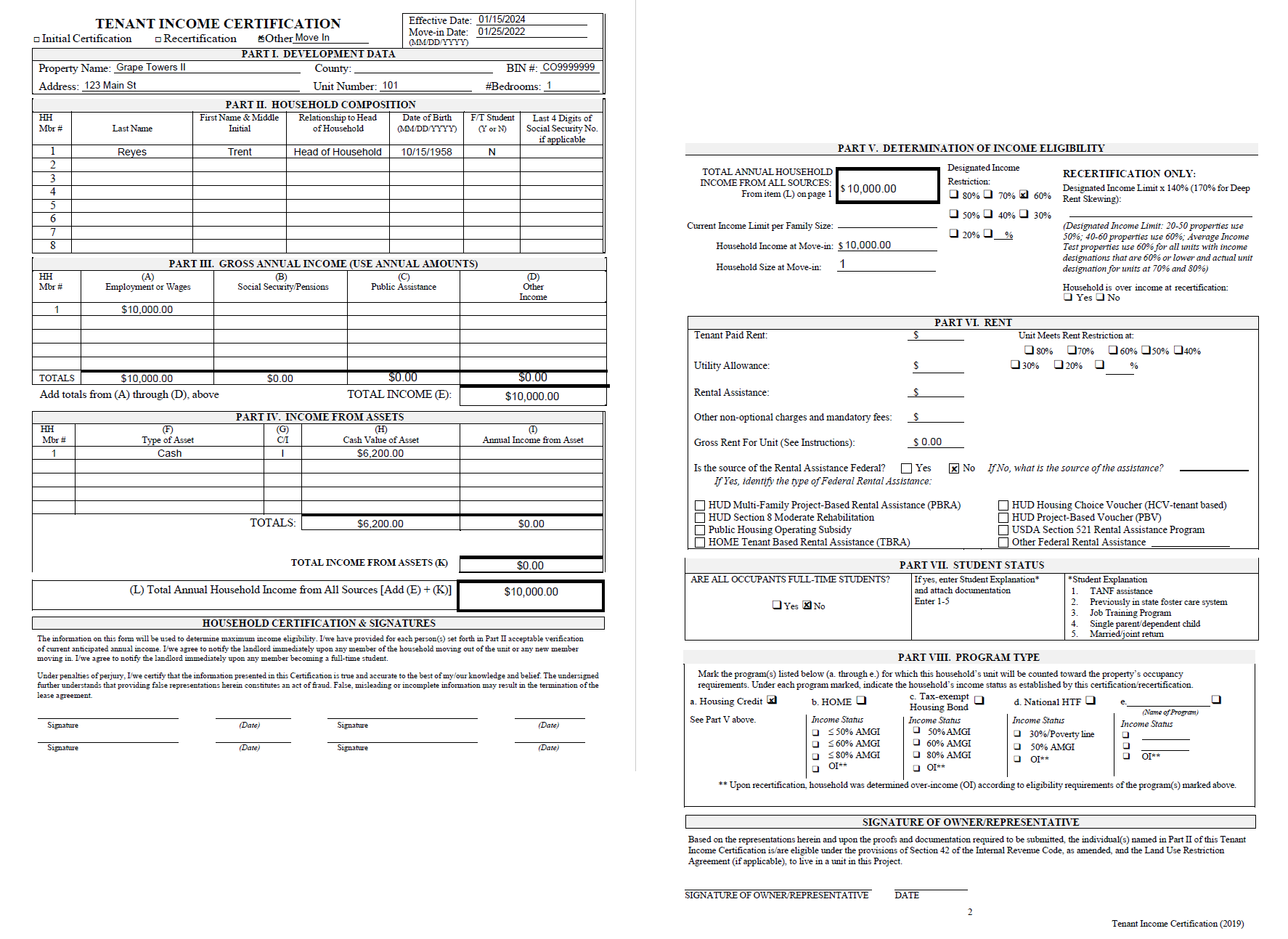

The system populates some information in the TIC form based on the data entered into the system, including some header info, property information, household members, household annual income, household income from assets, income eligibility, rent, student status, and program type.

If data has not been entered for a field in ProLinkHFA/Tenant Portal, then the data will not be populated on the form. For example, if the record is an average income property but no unit designation has been set, then the income and rent values on the form will not be populated.

Field | Description |

|---|---|

Header | |

Event Type | The name of the event. |

Effective Date | The tenant event date. |

Move-in Date | The initial move-in date. |

Part I Development Data | |

Property Name | The property name. |

County | The county name for the property building. |

BIN # | The building identification number assigned to the building. This field is blank when Additional Set-Aside is the only program on the property. |

Address | Address 1 and Address 2 for the building. |

Unit Number | The unit number from the tenant event. |

# Bedrooms | The number of bedrooms for the tenant event unit. |

Part II Household Composition The grid includes each household member. The head of household will be populated in row 1. All other household members will be listed in rows 2–8. If more than eight household members, then the form includes an overflow page. | |

Last Name | The last name of the household member. |

First Name & Middle Initial | The first name and middle initial of the household member. |

Relationship to Head of Household | The relationship of the household member. |

Date of Birth | The birthdate of the household member. |

F/T Student | Indicates if the household member is a LIHTC full-time student (Y or N). |

Last 4 Digits of Social Security No. | The last four digits of the household member's social security number. |

Part III Gross Annual Income The grid includes only eligible household income. For example, if the household includes a live-in aide or foster children, then they are listed in Part II, but their income will not be displayed in this grid. The member number will match the household member listed in Part II. | |

Employment or Wages | When the Income Source is set to the following, the system populates with the sum of all annual income amounts for the household member:

|

Social Security/Pension | When the Income Source is set to the following, the system populates with the sum of all annual income amounts for the household member:

|

Public Assistance | When the Income Source is set to the following, the system populates with the sum of all annual income amounts for the household member:

|

Other Income | When the Income Source is set to the following, the system populates with the sum of all annual income amounts for the household member:

|

Total Income | Sum of all income for all household members (sum of totals from Employment or Wages, Social Security/Pension, Public Assistance, and Other Income columns, including any overflow pages). |

Part IV Income from Assets The grid includes only eligible household income from assets. For example, if the household includes a live-in aide or foster children, then they are listed in Part II, but their income from assets will not be displayed in this grid. The member number will match the household member listed in Part II. | |

Type of Asset | The type of asset as selected on the Asset record:

|

C/I | The asset status selected on the Asset record:

|

Cash Value of Asset | The cash value enter on the Asset record. |

Annual Income from Asset | Displays the Annual Income value, if it is populated on the record. Displays the Imputed Annual Income value, if it is populated on the record. |

Cash Value of Asset Total | Sum of all assets for all household members (sum of all rows in Cash Value of Asset column, including any overflow pages). |

Annual Income from asset Total | Sum of all annual income from assets for all household members (sum of all rows in Annual Income from Asset column, including any overflow pages). |

Total Income from Assets | Sum of Totals row for column I (Annual Income from Asset). |

Total Annual Household Income from All Sources (page 1 and page 2) | Total Income plus Total Income from Assets, which will match the total eligible income in ProLinkHFA. |

Part V Determination of Income Eligibility | |

Current Income Limit per Family Size | When LIHTC is a program on the property:

When Additional Set-Aside is the only program on the property:

NoteFor average income properties, when the Unit Type = Low Income and the AIT Unit Designation = Excluded, the system will only populate the Current Income Limit Per Family Size field when the Most Restrictive Income Designation is entered. When the Unit Type = Market and the AIT Unit Designation = Excluded or Market, the system will only populate the Current Income Limit Per Family Size field when the Most Restrictive Income Designation is entered. |

Non Adjusted Family Size |

NoteFor average income properties, when the Unit Type = Low Income and the AIT Unit Designation = Excluded, the system will only populate the Non Adjusted Family Size field when the Most Restrictive Income Designation is entered. When the Unit Type = Market and the AIT Unit Designation = Excluded or Market, the system will only populate the Non Adjusted Family Size field when the Most Restrictive Income Designation is entered. |

Household Income at Move-in | The household income that was entered on the initial move-in event. |

Household Size at Move-in | When the Event Type is Move-In, then the system populates this field with the Total Household Members value. |

Designated Income Limit Restriction | Designated Income Limit:

NoteFor average income properties, when the Unit Type = Low Income and the AIT Unit Designation = Excluded, the system will only populate the Designated Income Limit Restriction field when the Most Restrictive Income Designation is entered. When the Unit Type = Market and the AIT Unit Designation = Excluded or Market, the system will only populate the Designated Income Limit Restriction field when the Most Restrictive Income Designation is entered. |

Designated Income Limit x140% (170% for Deep Rent Skewing) | The system calculates the LIHTC max income limit (based on the set aside) * 140% (or 170% for deep rent skew). For Average Income properties, the calculation is as follows:

Deep Rent Skew Income is blank when Additonal Set-Aside is the only program on the property. |

Household is over income at recertification | If the value for Total Household Income is greater than the LIHTC Max Income 140% (170% Deep Rent Skew), then the system selects the Yes checkbox. If the value for Total Household Income is less than the LIHTC Max Income 140% (170% Deep Rent Skew), then the system selects the No checkbox. This field is blank when Additional Set-Aside is the only program on the property. |

Part VI Rent | |

Tenant Paid Rent | The Tenant Paid Rent value on the tenant event. |

Utility Allowance | The Utility Allowance value on the tenant event. |

Rental Assistance | Total of the Federal Rent Assistance Amount and Non Federal Rent Assistance Amount. |

Other non-optional charges and mandatory fees | The Other Non Optional Charges value on the tenant event. |

Gross Rent for Unit | Tenant Paid Rent + Utility Allowance + Other Non Optional Chargers |

Unit Meets Rent Restriction at | The system uses the Most Restrictive Rent Designation field to populate these checkboxes. The system will match the percentage if there is an exact match; otherwise the system will check the Other box and populate with the percentage that was entered. |

Is the source of the Rental Assistance Federal | If any of the following are selected in the Federal Rent Assistance Source field, then the system selects the Yes checkbox and then selects the corresponding assistance checkbox:

If the Federal Rent Assistance Source field = --Select--, then the system selects the No checkbox. |

If no, what is the source of the assistance | The system populates the field with the Non Federal Rent Assistance Source value: Section 8 Voucher Section 8 Project Based Rural Housing Service Other Assistance |

Part VII Student Status | |

Are all occupants full-time students | If all household members are LIHTC full-time students, the system selects the Yes checkbox. If at least one household member is not a full-time student, the system selects the No checkbox. This field is blank when Additional Set-Aside is the only program on the property. |

If yes, enter student explanation | When all household members are LIHTC full-time students, the system populates with the number based on the Full Time Student Exception value:

If none of the exemptions apply, then the household is ineligible to rent the unit. This field is blank when Additional Set-Aside is the only program on the property. |

Part VIII Program Type | |

List of program(s) for which the household's unit will be counted toward the property's occupancy requirements | If LIHTC is selected on the tenant event, then the system selects the Housing Credit checkbox on the form. If HOME is selected on the tenant event, then the system selects the HOME checkbox on the form. The system will not automatically populate the other program checkboxes or Income Status checkboxes. |